|

|

|

|

|

|

|

|

|

|||

|

|

|

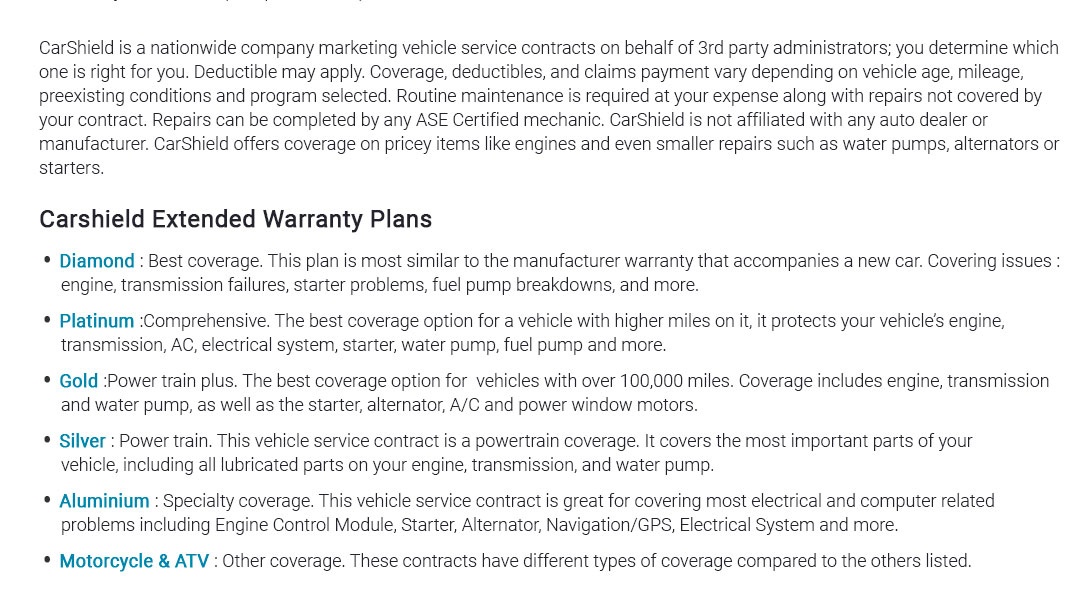

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

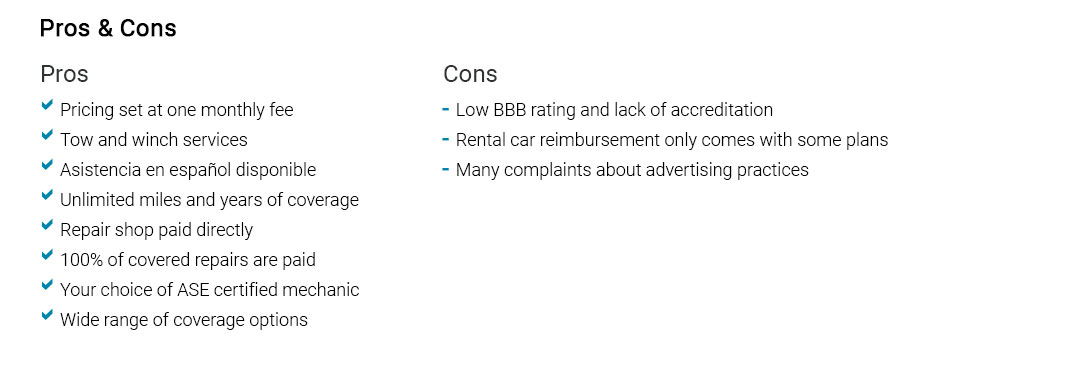

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

vehicle protection plan choices for drivers who think aheadI'm sorting through options because repairs feel random yet inevitable. A vehicle protection plan steadies the budget; factory coverage ends eventually. I want coverage that fits my driving, not the other way around. Coverage fit: compare before you commit

Small pause - costs matter, surprises matter more. Costs, claims, and timing

A real momentOn a snowy evening, my dash lit up: ABS fault. The plan covered diagnostics and a wheel-speed sensor at my regular shop. No bargaining, just a modest deductible - then back on the road. How I decideI compare total five-year cost, likely failure points on my model, and cancellation terms. If numbers stay sensible and coverage matches real risks, I proceed. If not, I skip it and build my own repair fund. https://www.autonation.com/protection-plans/all-products

A mechanical breakdown service contract that covers the costs of parts and labor for covered repairs. https://www.autonation.com/protection-plans/autonation-vehicle-protection-plan

We offer five different levels of comprehensive coverage plans to keep your vehicle protected while you own it.! https://www.protectiveassetprotection.com/pvpp-consumer-info

The Protective Vehicle Protection Plan helps protect you against the rising repair costs of mechanical failures. With multiple coverage levels, our vehicle ...

|